With respect to the expense of buying a home, of a lot possible home owners work with closing costs and also the mortgage payment. It a lift, yet not, there are many almost every other relevant can cost you to look at. Learning how to reason behind all the upfront and ongoing can cost you, along with your means in the place of the desires, makes it possible to build your last to purchase decision.

Costs of buying property

One which just step to your this new fantasy home, possible pay numerous initial can cost you. There are also many can cost you which can be ongoing. Delivering this particular article under consideration and event prices makes it possible to bundle and you can funds because you action on the home buying process.

- Earnest money deposit

- Downpayment

- Moving will set you back

- Settlement costs, and additionally assessment and you will household inspection will set you back

- Property taxation

- Home loan insurance policies

- Homeowners insurance

- People connection (HOA) costs

- Home fix

- Tools

Serious Currency Deposit

A serious money deposit, or serious fee, try currency you pay at the start once and make a deal towards a home. The new serious payment, which is constantly 1-2% of one’s purchase price, are paid off shortly after a buyer and merchant enter into a buy agreement. Regarding the seller’s perspective, the newest earnest money deposit shows that the offer is actually major. Immediately following closing, this new put is applied to the latest buyer’s down payment otherwise closure can cost you.

Deposit

Of several products get into deciding the downpayment, and/or part of your own house’s cost that you pay upfront. The typical advance payment enjoys ranged of six% to help you seven% having very first-time customers as 2018 and you can doing 17% for repeat consumers. Remember that more substantial downpayment will change so you can a diminished month-to-month mortgage repayment. A deposit less than 20% might basically require that you shell out personal mortgage insurance (PMI) if you don’t reach the 20% equity level.

Moving Can cost you

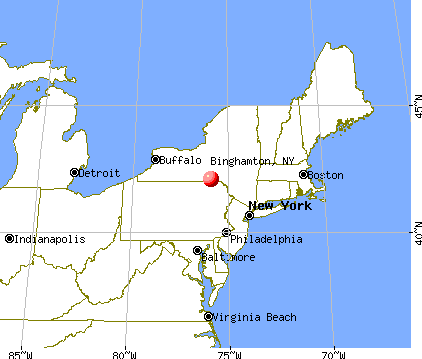

Their moving can cost you varies according to how big is your property as well as how far you must take a trip to suit your move. Including, to own a single-bed room apartment, a location circulate could cost on $five hundred. Although not, an aside-of-county go on to a home with four or five bedrooms a lot more than simply step 1,000 distant could cost up to $10,000.

Closing costs

Typical settlement costs having a house may include an abundance of things, together with financing origination charges, assessment charge, home review, identity look, label insurance policies, fees and you may people disregard products you may want to spend. Make sure you lookup settlement costs based on where you’re to find your property, just like the closing costs vary because of the condition. The fresh U.S. average closing prices having customers within the 2021 was $3,860 instead of transfer taxation and $6,905 with import fees. Specific says try not to impose americash loans Noroton a transfer tax towards a home. When it comes to those who do, where you live will determine whether or not your or even the provider is actually guilty of which rates.

Property Taxation

Part of the situations one to influence how much you only pay for the assets taxation on your house ought to include the size of your residence additionally the regional tax price in your geographical area. An average possessions taxes on the You.S. go for about $2,500 a-year but could are different generally because of the state, ranging from in the $five hundred around more than $8,000.

Home insurance

The common price of homeowners insurance in the U.S. is actually $step 1,272. Although not, like many most other will set you back of buying a home, the price of homeowners insurance may vary according to dimensions and place of your house. In addition to, property owners living near water must envision flood insurance rates, that is an alternate rules.

HOA Costs

When you find yourself to buy property in the an exclusive people, you’re necessary to shell out a people connection (HOA) commission, and therefore goes toward since the community’s yearly doing work funds. The common HOA commission get range between $two hundred to $300 four weeks, but so it count may differ commonly.

Нет Ответов