If you find yourself squirreling aside currency to pay off obligations, you may be ignoring one of the primary property which could help: your house.

Borrowing from the bank against your house collateral — and/or difference in how much cash your home is really worth and simply how much is actually left on your mortgage — is the the answer to consolidating loans and ultimately saving a great ton into the notice.

Property owners throughout the U.S. are currently looking at an archive most of more than $thirty-five trillion in home collateral, with respect to the Federal Set aside Bank out-of St. Louis. That is the instance whilst People in america are also racking up borrowing from the bank credit obligations — owing a collective $1.fourteen trillion.

The result is an effective rebound inside the notice to have domestic guarantee contours away from credit, or HELOCs. These things, sometimes referred to as next mortgage loans, allows you to obtain and spend doing a certain borrowing from the bank maximum, next pay the money on a plan decided ranging from your plus financial. If you find yourself interest in this type of investment dropped for most of the new 2010s, these days it is jumped 20% since the 2021, this new Government Bank of new York recently claimed.

Read on on positives and negatives of employing HELOCs while the a debt negotiation equipment, including ways to use the fresh new guarantee of your property to blow regarding your debt.

Pros and cons of employing an excellent HELOC to pay off their costs

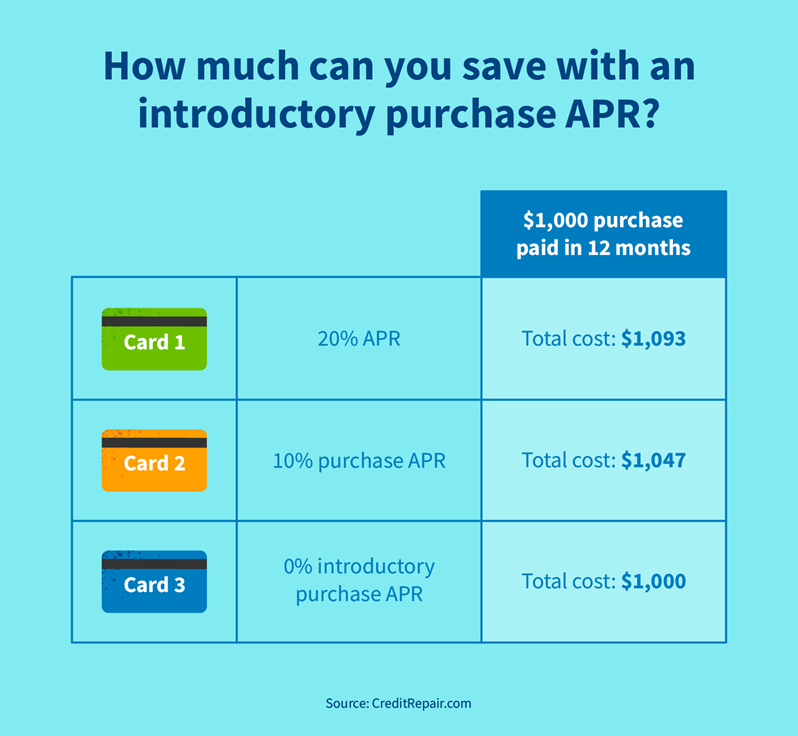

If you’ve collected excessively loans, particularly high-appeal financial obligation including charge card stability, good HELOC can be handy into the snagging a lower life expectancy interest rate. New cost into HELOCs today begin at the more or less nine% — notably below the average apr (APR) towards the credit cards, which is more than 22%, minimizing than just actually among the better personal loans.

Given that HELOCs cannot normally leave you a swelling-contribution commission, they also provide a tad bit more liberty than other form of loans. These products is actually rotating lines of credit, so that you takes the cash as needed out of extent approved and you will control exactly how much obligations your gather. You have to pay interest towards matter you in fact withdrawn of the personal line of credit.

There is independence up to how you utilize the HELOC, since there commonly any limitations dictating everything have to set the bucks to the. (Household equity funds, a brother for the HELOC, performs similarly but they are delivered since the a lump sum, and you may begin repaying interest into full number instantaneously.)

In the past, interest paid loans Hooper with the a good HELOC are tax-deductible regardless of what your spent it. Men and women rules possess changed now the latest continues must be placed on family plans into the earnings becoming qualified to receive a tax deduction, in the event that’ll alter once more subsequently. (Should this be a significant outline to you personally, it is advisable to talk to an income tax coach.)

Youre credit against your house guarantee and you are clearly getting your own house up as guarantee, thus regarding bad circumstances circumstances, the lender fundamentally features good lien on the house, says Glenn Downing, creator and you can dominating out of financial support consultative corporation CameronDowning. You are putting your own family members’ quarters on the connect.

Of course the value of that house drops, could cause due over exacltly what the residence is value.

Specific lenders render repaired-rates HELOCs that are best for debt consolidation reduction. However, usually, HELOCs feature changeable interest levels, you may not be able to protect a reduced fixed rates and may even suffer from action when you look at the your own asked costs. Translation: You can spend so much more whenever rates of interest increase.

HELOCs can also allow appealing to take on alot more obligations. You could potentially usually get an effective HELOC that’s worthy of as much as 85% of your home collateral. Which means if you have $150,000 property value guarantee, you can have accessibility a personal line of credit around $127,five-hundred — far more than you possibly might have to pay from the highest-desire obligations. Mike Miller, a monetary advisor at the Integra Shield Financial Classification, claims which he usually asks subscribers that happen to be trying to find HELOCs as to why they need that more funds.

Making use of an excellent HELOC to pay off your financing

By using a great HELOC or household equity financing in order to consolidate your financial situation, you will be fundamentally borrowing from 1 origin (your home) to settle most other, more pricey sources of obligations (such as your credit cards).

When you rating an excellent HELOC, your financial will establish just how much in your home guarantee you can borrow against. With this first rung on the ladder, be prepared to pay some initial will cost you such as application or origination costs.

After your loan has been funded, you can start using throughout what’s called the borrowing from the bank months or draw period. Your ount or borrow at least amount each time you withdraw from the line of credit, with respect to the conditions in depth regarding HELOC agreement. As soon as you get the cash, you could start settling their more costly expenses.

Generally speaking having good HELOC, you spend the cash as needed; which can generate HELOCs of use if you prefer self-reliance to help you very first combine your financial situation and also certain usage of most borrowing from the bank across the coming many years. Actually, Miller states he will often prompt members to establish good HELOC actually once they never propose to instantly make use of the money, according to their problem.

In the event that, on top of that, you are aware you merely want to use the bucks getting an excellent one-date credit debt rewards, you will be better off having a home guarantee loan than simply a beneficial HELOC. With this specific financing, you can use the thing you need to blow off their higher-rate stability, after which immediately begin repaying the lower-price debt.

For the borrowing from the bank period of good HELOC, which usually persists five so you’re able to 10 years, you are able to payments towards a number of the dominating as well as the attention, or maybe just the eye. Without a doubt, in such a case, the objective of having fun with an effective HELOC is to try to create much easier to expend down your debts. To prevent a repeat where you are facing unaffordable payments once again, it’s best to pay more than simply the attention so that your money you should never balloon subsequently.

Because the mark several months is more than, it is time to enter the payment months where you can easily repay the loan, tend to more than ten to fifteen many years, otherwise pay back the complete equilibrium, dependent on your agreement. You could potentially pay their HELOC early, regardless if your own financial may charge a beneficial prepayment punishment.

Нет Ответов