Are you willing to feel overwhelmed by readers researching ways to perform the debts? Are you aware that 77% out of American households is actually discussing some type of financial obligation? Handmade cards, unsecured loans, expected house solutions, college or university expenses, scientific payments the list of financial obligations shall be limitless. American house carry $ trillion with debt at the time of Q2 2024, averaging $104,215 per house. Because loans-ridden facts appears like a headache, an excellent lifeline really does can be found. Debt consolidation reduction and cash-out refinancing are two effective measures that may somewhat improve a debtor’s financial predicament. Talking about an effective way to describe complex personal debt agreements, lower rates of interest, and you may possibly accessibility even more funds.

It’s important to just remember that , it jobs in different ways and you can suit various other monetary issues. Very, since a large financial company, this is your activity to understand this new nuances off debt consolidation and you may cash-away refinancing in order to bring your customers with pro pointers to help them pick the best loans government solution.

- Most of the functions in hand

- Easy-to-explore easy to use software

- Provided AI tech

A&D Home loan was committed to that provides not just exceptional provider and designed options as well as useful information. That is why we are right here in order to find out more about debt consolidation and cash-away refinancing as well as how capable work with customers.

What exactly is Debt consolidating?

People e big date. Personal loans, credit cards, college loans it could be a lot to juggle with various due dates and you may rates. That is where debt consolidating is available in. It is such as for example combining all their costs into just one, in balance loan. Instead of while making multiple payments every month, they only have one. The primary benefit of this plan was simplicity to suit your readers. Permits these to manage the personal debt, making it easier to cope with by the focusing on just one monthly commission.

Furthermore, brand new mortgage tend to comes with a lower life expectancy interest than simply a debtor is actually purchasing in advance of monthly installment loans Hamilton ND, that could lead to using less within the notice costs over living of your loan. Along with, merging expense might help your visitors enhance their credit ratings, making it simpler to get funds afterwards.

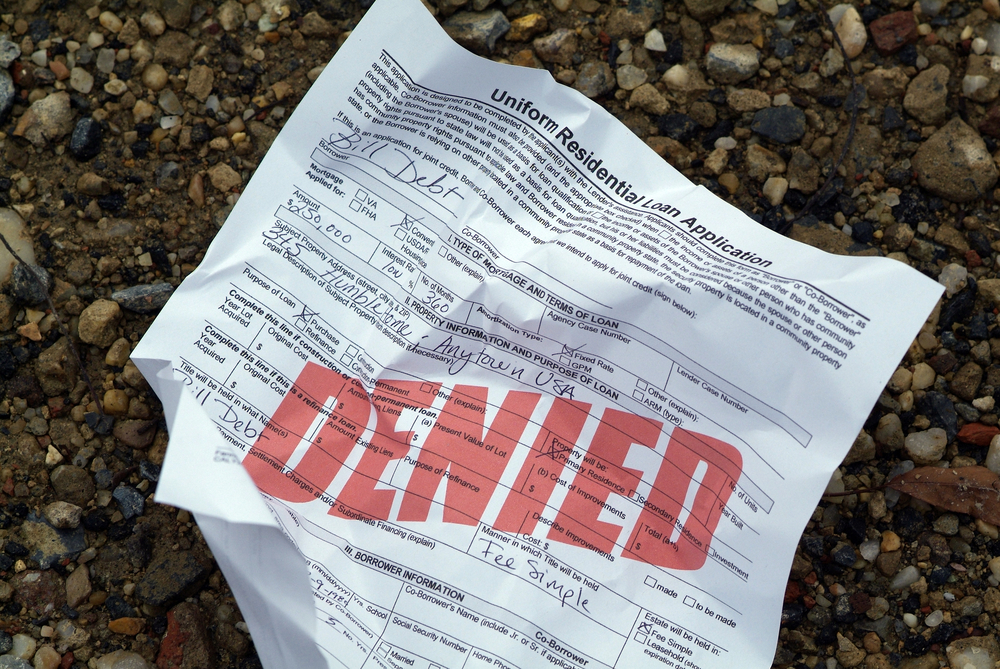

You will need to note that, truth be told, debt consolidation reduction isn’t only getting personal credit card debt. It can be a simple solution for various expense, including scientific bills, figuratively speaking, as well as domestic collateral finance. At exactly the same time, particular get mistake debt consolidation that have bucks-out refinancing. When you find yourself both is a good idea when you look at the handling debt, these are typically line of tips. Debt consolidation reduction normally comes to taking out fully a different sort of mortgage, often unsecured, to pay off present personal debt. In contrast, cash-out refinancing substitute a recent home loan that have a larger that, allowing a borrower to gain access to a lot more financing. Due to the fact a home loan elite, you will have a definite picture of bucks-out refinancing vs. debt consolidation, which we’re going to discuss in more detail next.

What is Cash-Out Refinancing?

Cash-out refinancing was a technique enabling residents to access new collateral they will have collected in their assets. The latest mechanics is actually fairly straightforward. Consumers exchange its latest financial with a new one that’s larger and you will receive the difference in bucks. That it bucks may then be studied for various purposes, together with debt consolidation reduction, and come up with renovations, investments, or any other expenditures. This tactic are beneficial because it have a tendency to offers a reduced interest compared to the other types out of loans. Therefore, one of the most preferred uses for cash-out refinancing will be to consolidate large-appeal personal debt. By merging several expenses toward just one, lower-appeal mortgage, home owners can potentially save well on focus money and you can make clear the financial lives. This really is an easy method out, specifically for men and women struggling to keep up with numerous monthly payments.

Example

Let’s bring a potential scenario including. Guess your client enjoys $70,000 when you look at the highest-attract credit card and private loan loans. They own good $400,000 family and you can owe $250,000 on the home loan. Once they make use of the bucks-away alternative, they may be able re-finance the mortgage to own $320,000. In that way, the fresh loan will pay off the modern $250,000 mortgage and can have the kept $70,000, which the client will get due to the fact bucks. They’re able to utilize this bucks to pay off their high-focus personal credit card debt and you may combine it towards one mortgage percentage that have a lower life expectancy interest rate.

Нет Ответов