Very homebuyers are not aware one disputing an excellent tradeline account for the their FICO credit file can actually get the financial declined otherwise reduce the closure.

In an attempt to increase otherwise fix a credit score whenever getting ready to loans property pick otherwise refinance, of several homebuyers get borrowing repair’ companies that will conflict all of the derogatory profile, perhaps the legitimate ones, hoping the creditor does not function or examine the debt with-within a month.

If creditors never address new disagreement having-within a month, the financing bureaus, (Experian, Transunion, and you may Equifax) are required to miss these types of account on the people credit history…..that could boost he buyer’s FICO credit score.

They amazes myself you to definitely so many business professionals are perhaps not conscious that Federal national mortgage association, Freddie Mac computer, FHA, new Va, and you will USDA provides current their being qualified advice requiring debated borrowing from the bank account go off otherwise up-to-date to declaration once the resolved’.

What’s Completely wrong Having Disputing Completely wrong otherwise Derogatory Borrowing?

There’s nothing actually wrong that have disputing the borrowing from the bank tradelines, but when you are planning to financing a house, there’s two big problems that affect mortgage being qualified that will occur.

Whenever a lending company works new individuals application for the loan owing to a keen automatic application loan acceptance program who has got disputed collection, charge-offs, and other account which have a history of late costs, the fresh profile commonly within the borrowing from the bank exposure investigations. This can will offer a great incorrect positive’ recognition.

- Debated tradelines often artificially and you may temporarily improve a consumers credit ratings as FICO credit scoring algorithm doesn’t come with the newest fee history otherwise obligations related specifications regarding score. Here is what really borrowing from the bank resolve gurus rely on to secret your toward convinced he could be increasing your credit rating…..they just be sure to game’ the latest FICO scoring system.

Federal national mortgage association Rule into Debated Tradelines

Whenever Desktop Underwriter situations a message stating that DU known a beneficial disputed tradeline which tradeline was not within the borrowing from the bank risk investigations, loan providers must make sure brand new disputed tradelines are considered about borrowing chance evaluation because of the often getting a separate credit history to the tradeline don’t reported just like the disputed and resubmitting the borrowed funds casefile in order to DU, or yourself underwriting the mortgage.

If the DU will not question the fresh new debated tradeline message, the financial institution isn’t needed to investigate otherwise see an updated declaration.

Special Mention: the lender is required to ensure that the fee on tradeline, if any, is included regarding personal debt-to-earnings proportion whether your membership does fall under the borrower.

Because the dispute is completely removed or fixed on agency peak, the credit statement have to be re-focus on therefore the automatic re-go to find out if it nevertheless approves.

FHA and USDA Rule into Debated Tradelines

Disputed accounts on borrower’s credit history are not sensed into the the financing score used by Total Home loan Scorecard inside the rating the fresh new app. Therefore, FHA and USDA necessitates the financial to take on them throughout the underwriting research due to the fact described below.

Va loans and you can Debated Tradelines

The brand new Virtual assistant has no one formal wrote guidance regarding the approaching of debated accounts however, loan providers will usually follow the FHA wrote direction.

Tips guide Underwrites and Disputed Tradelines

If you find yourself incapable of remove the disputed updates otherwise incapable to obtain the creditor so you’re able to statement it fixed, Fannie mae and you can FHA doesn’t deal with an automated acceptance and you may down stages it in order to a handbook underwrite. What exactly, fuss, best? Bring about the latest guidelines underwrite!

- Tips guide underwrites have a tendency to maximum DTI ratios’ in order to 41% or 43%. This will somewhat remove just how much your qualify for.

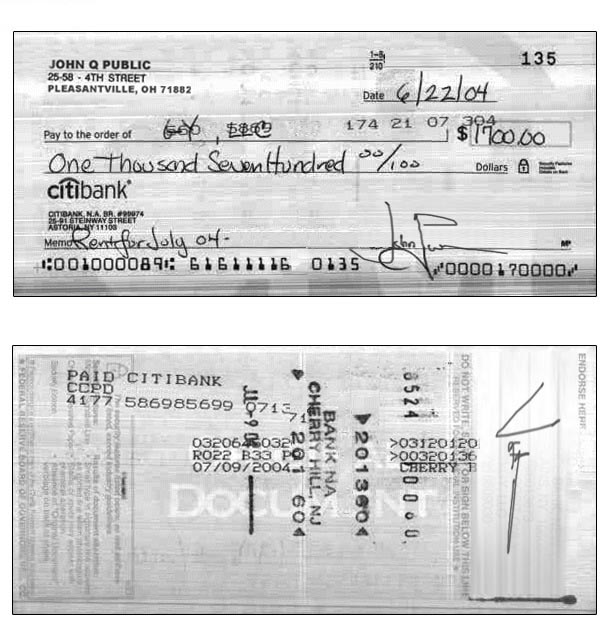

- Tips guide underwrites can occasionally want a verification off book which have terminated checks to prove lease is actually paid back promptly.

- Guidelines underwrites can take stretched.

When your borrower try not to meet with the tips guide underwriting criteria necessary for a loan acceptance, it does will bring 2+ days to discover the debated tradelines in order to statement due to the fact resolved. This will commonly push you to be miss their closure time and you can the vendor may take your own hard-earned serious currency put getting failing continually to manage on transformation price.

If you are getting ready to rating pre-recognized, you should know the difference between a great pre-certification and you will an effective pre-acceptance. find more It would be best if you work with a mortgage lender (at all like me) who knows what you should discover One which just enter into deal while having set-off upwards because of the anything while the shallow as this.

I know the guidelines and you can I am proactive so you can stop barriers that can threaten the earnest money put and you can cause a good countless unnecessary be concerned seeking boost.

I could feel reached in the (951) 215-6119 or get in touch with me here to talk about exactly how good PreferredBuyer Virtue mortgage pre-acceptance can benefit your.

Нет Ответов