The fresh federal government’s earliest mortgage deposit strategy can assist men and women whom be considered, but at the expense of individuals who dont, writes UNSW Sydney’s Nigel Stapledon

With casing cost set to getting an option election topic, this new 2022 government finances grows this new program the brand new Coalition submit at 2019 election to assist first homebuyers.

The first Home loan Deposit Program support those with no basic 20 percent put required by mortgage brokers. In the event you meet the requirements, they guarantees around 15 % away from a beneficial loan’s worth, meaning people can safe a home loan that have good 5 for each and every penny put.

In the 2021-22 economic seasons the fresh scheme are capped within ten,000 locations. The 2022 budget are broadening which to thirty-five,000 a-year, along with an additional ten,000 towns and cities to have earliest homebuyers for the local components. It is going to grow a category getting solitary moms and dads introduced for the the brand new 2021 finances, making it possible for particular to enter which have a two percent deposit, improving the cover so you’re able to 5,000 per year.

Government applications to greatly help first homebuyers try regularly criticised given that simply getting up tension for the prices, getting no genuine benefit to first homebuyers. That it scheme commonly push-up pricing, although not by exact same matter because value of this new guidelines.

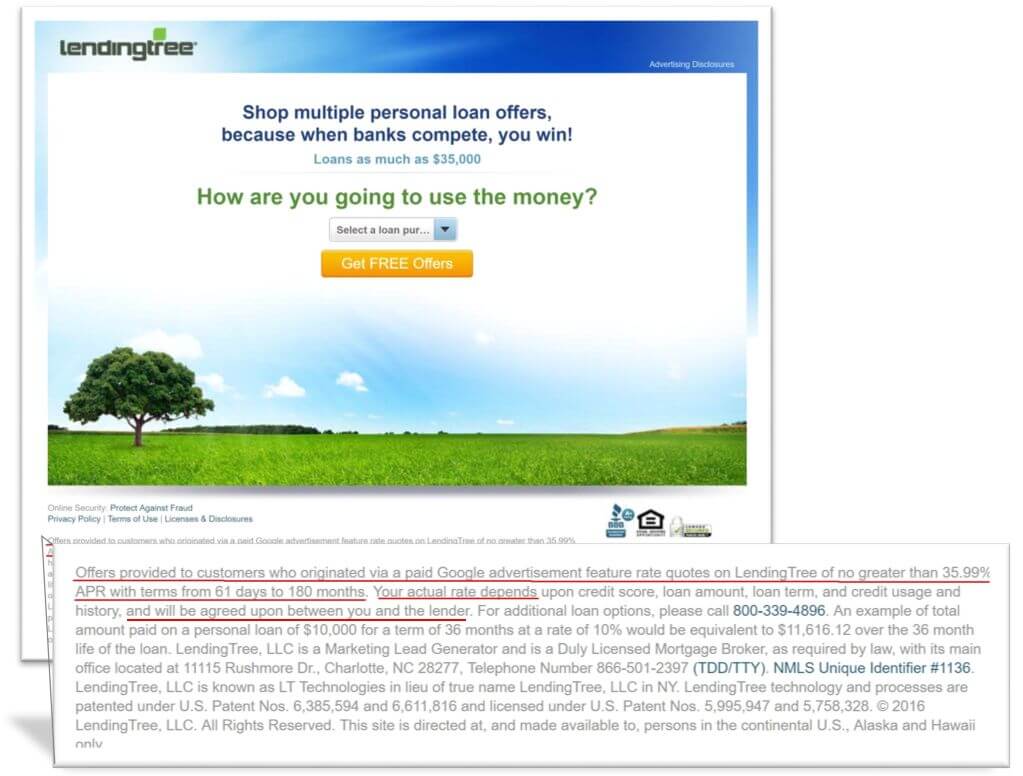

You to side-effect of your own Very first Financial Deposit Design was this forcibly pushes up family prices, which makes them unaffordable for others. Image: Shutterstock

What is operating upwards property cost

Australia’s seemingly large housing costs can also be usually end up being attributed to the newest extreme tax advantages for assets control and you may rigidities into also have top, for example zoning or any other regulatory constraints. Prior to now couple of years, these types of things was supplemented because of the potent mixture of COVID-19 and low interest rates.

This has been an international experience, never book so you’re able to Australia. The functional-from-house wave caused an increase needed to have huge home and you may a shift so you can rural and regional components at the same time since main banking institutions pressed specialized interest levels next to no so you can turn on faltering economic climates.

A moment-best choice

New put ensure scheme to simply help very first home buyers is exactly what economists label one minute-best option. A maximum solution carry out a lot more really target the latest demand and supply grounds operating upwards cost. In place of this, brand new government’s plan will be to give basic-homebuyers a boost over someone else.

One ailment instance a plan just increases every vessels and you will throws upward pressure towards prices is not a bit best. It does push-up cost, but not because of the exact same number as worth of the latest financing claims. To do that every buyers would need to get the same concession, there needed to be no effect on the supply out-of property. Also have regarding housing industry tends to be sluggish to react however, it installment loans online Miami Texas can change having request.

Over the past couple of years, basic home buyers have made right up on 20 per cent out of all of the customers. That it system, despite the newest offered cap, can benefit not even half one matter on seven % of all the buyers.

And so the design will have specific affect assets prices, however adequate to counterbalance the value of the support so you’re able to those people buyers whom be considered. In addition, men and women swapping belongings pays marginally alot more. Thus commonly traders, and you can renters in the owed course.

The big anxiety about the brand new put strategy ‘s the chance you to definitely those people utilizing it to order a property are able to enter financial troubles and default to their financial. Image: Shutterstock

Higher control, greater risk

The big concern with this program ‘s the exposure men and women playing with they to get a property are able to enter financial problems and you can standard on their home loan.

It was an adding factor in the usa subprime mortgage crisis one to lead to the global financial crisis from 2007-08. Formula designed to rating reduced-money homes on the field seemed to functions until the drama struck. Next household cost tumbled and some have been compelled to offer in the huge loss.

After you leverage upwards, borrowing from the bank 95 per cent otherwise 98 percent of really worth out-of a property, youre even more open in the event that prices slide. Also a small decline you will over wipe out your guarantee.

Housing isnt exposure-free. Time issues. Domestic pricing can be slide together with rise. That have rates of interest rising and you may huge all over the world economic suspicion, certain negative effects from this plan on the song can not be ruled-out.

Nigel Stapledon are a research Other inside A home at Heart getting Used Financial Look, UNSW Sydney. A version of this particular article featured on the Discussion.

You are able to republish this information each other online and during the printing. We query you go after some effortless recommendations.

Excite dont change the brand new section, remember to trait the author, the institute, and you may explore that blog post try to start with had written on Team Imagine.

Нет Ответов