Condition Farm’s financial and money process have alongside two decades of expertise, giving a multitude of membership, investment car, and you can fund in order to people. Lender operations include a capable team from into the-domestic fiscal experts who’re oftentimes supplemented from the State Farm agencies. The program process within State Farm begins with a phone otherwise in-people dialogue having a mortgage-licensed broker.

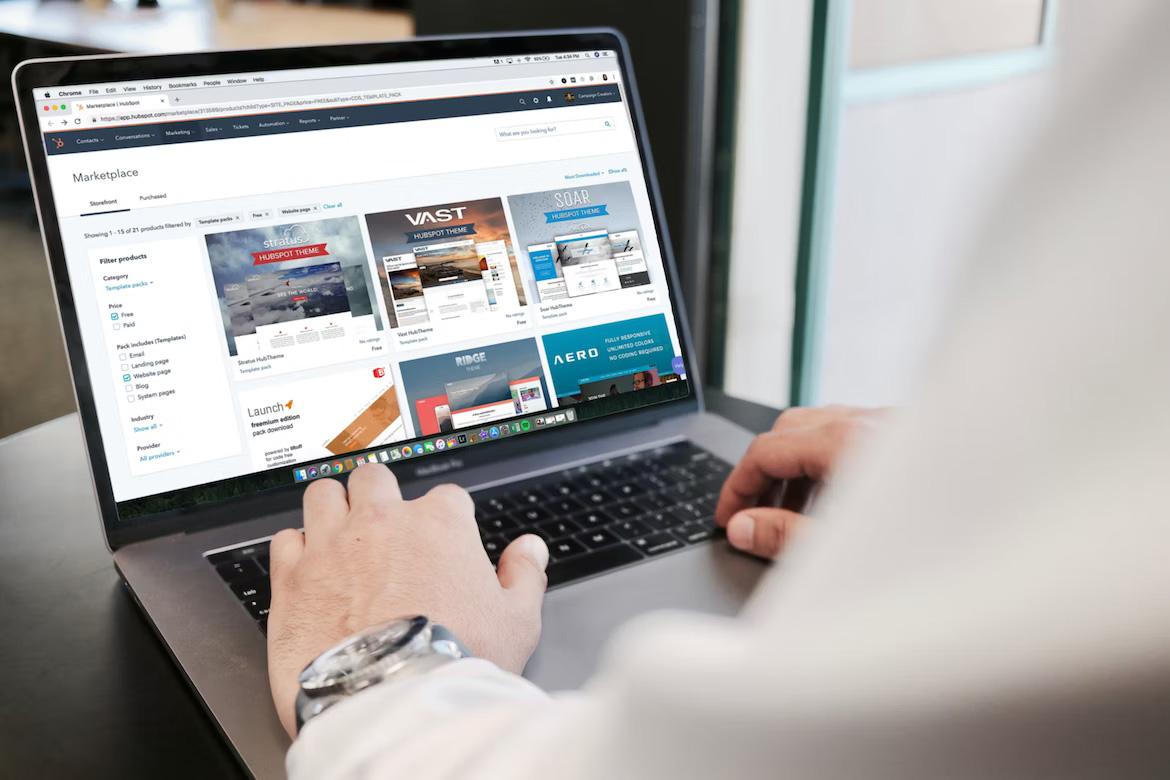

The company now offers an online mortgage heart and you can allows applicants in order to tune progress on line. Condition Farm brings a number of other academic posts, resources and you will entertaining property, plus a customized financing finder system and you can a purchasing vs renting calculator.

Condition Farm does not appear on the fresh J.D. Fuel Priong the businesses listed in an individual Monetary Safety Bureau’s problem statement. State Ranch doesn’t record its mediocre for you personally to closure. Potential borrowers need to keep the fresh federal time-to-personal mediocre off 41 weeks, determined by the Ellie Mae, in your mind.

State Farm Lender Character

State Farm Bank also provides a number of banking and you may economic services, in addition to lenders. Its head office would depend during the Bloomington, Illinois. It absolutely was based during the 1999. The book Nationwide Home loan Licensing Program ID amount was 139716 and you may was a member of the FDIC and you can an equal Construction Bank.

Nearly all their workplaces commonly licensed or ranked of the Top Business Bureau, but the couple which might be provides A+ ratings. New headquarters venue have an average user score off simply more than 1/5 famous people and you can step one,937 issues closed in the prior 3 years.

Yet not, a life threatening almost all such grievances and product reviews is linked with the company’s insurance rates products plus don’t offer understanding of the home loan surgery. It has no product reviews into Trustpilot. The fresh NMLS got two enforcement strategies up against County Ranch Financial in , as CFPB does not have any checklist away from past steps.

- Advice collected to the

Condition Ranch Mortgage Qualifications

If you’re County Farm helps make a point so you’re able to list rate guidance and you will almost every other information regarding their home loans, it will not make recommendations in the minimal credit scores, popular debt-to-money rates or any other guidance offered. Those looking for making an application for financing which have State Farm is find out more through getting in touch with the organization.

A basic comprehension of credit ratings is actually priceless since you begin the procedure of seeking out a home loan. Keep the after the advice at heart because you consider your financial choice. Basically, large fico scores can cause alot more favorable costs and words, since mortgage brokers get a hold of such individuals given that which have a reduced height off exposure.

The contrary tends to be genuine away from down results. While many other variables come in enjoy, your credit rating are a significant section of protecting a house financing.

How exactly we Comment Mortgage brokers

A good Economic Dollars assesses U.S. mortgage brokers which have a pay attention to mortgage products, customer service, and full honesty. We strive to add a balanced and you may in depth direction getting possible consumers. We focus on article transparency in most our ratings.

From the obtaining research directly from loan providers and you can carefully reviewing financing terminology and you may criteria, i be certain that an intensive comparison. Our lookup, with actual-community views, molds our assessment procedure. https://paydayloancolorado.net/mount-crested-butte/ Loan providers was upcoming ranked on the individuals activities, culminating inside the a star score from 1 to four.

Getting a further comprehension of this new standards i used to rates mortgage lenders and our very own testing approach, excite relate to our very own editorial recommendations and you can complete disclaimer .

State Ranch Home loan Remark

Equipment Malfunction: County Ranch was a highly-recognized insurer which also even offers home loan attributes. He could be a professional lender that gives various mortgage solutions and you can of good use support service.

State Farm is a huge insurance coverage and economic qualities business you to definitely has been around business for more than 90 many years. The organization has the benefit of many products, together with vehicles, house, and you will term life insurance, and banking and you may financing services.

Нет Ответов